FINANCIAL AID

Grants, Loans and Scholarships

Although Boricua has no guarantee of regular support from outside sources, the College accepts the challenge of making its educational programs available to all who need and want to study. Meeting this challenge means students must be willing to apply for financial assistance from government and private sources. The staff of the Financial Aid Department assists students in developing the best possible package of financial assistance including grants, scholarships, loans, and other sources:

Financial support for tuition and non-tuition expenses is critical to Boricua’s students. As noted in previous chapters, the College consistently maintains a relatively low tuition rate, in fact, the lowest of all private, not-for-profit colleges in New York State, the third lowest in the United States mainland. The tuition is also competitive with the public colleges. The financial aid department has been successful in guaranteeing that students have a complete understanding of all available public and private tuition aid programs, and assists them individually in exploring and acquiring all the aids for which they qualify. All registered students are required to apply for financial aid. 88% receive some financial aid, and 50% receive the maximum level.

The Financial Aid department works in concert with the Admissions Departments from the beginning of a student’s life at the College, monitoring attendance and retention in partnership with the Academic Administrators in order to prepare a personalized plan of financial aid for each student. In the past three years, through the efforts of the financial aid department, the students have received an average of: $6 million per year in federal (Title IV) grants toward tuition and living expenses, an average of $1 million dollars in federal direct loans, $4 million in State grants, and approximately $65,000 yearly in direct grants from the institution. This represents a major achievement in financial support of the students.

In order to receive assistance from the Student Financial Aid (SFA) programs, a student is required to meet the following basic requirements:

U.S. Citizenship or eligible non-citizen status.

Regular Enrollment in an eligible program.

Academically Qualified for post-secondary level education.

Maintain Satisfactory Academic Progress (SAP) in the chosen course of study.

Signed certifications regarding:

Updated accurate personal information

Registration status

Statement of Educational Purpose

Refunds and defaults

Compliance with loan repayment schedules for SFA grants/loans.

Has not borrowed in excess of loan limits

Registration with the Selective Service, if required

Demonstrate Financial need

Transfer students must provide the College with an Academic Transcript prior to final certification of grants.

Meet attendance requirements as determined by federal regulations

In addition to these general requirements, some financial aid programs may have other requirements.

General Eligibility Requirements

These financial awards are given to students who fulfill academic and financial need criteria established by the Federal and State governments and the College’s administration:

Pell Grants Federal government awards to eligible students for tuition, books and other educational costs.

TAP New York State Tuition Assistance Program awards to eligible students to cover tuition costs.

FSEOG Federal Supplementary Educational Opportunity Grants help students with exceptional need pay for their education. Eligibility is dependent on financial need and satisfactory academic progress. Priority is given to students who receive federal grants. (See FSEOG procedures.)

Grants

Due to the spiraling costs of higher education most college students in the United States have found it necessary to finance at least a portion of their educational costs through long-term loans. Boricua students may turn to the following lending sources to round out their financial aid packages:

William D. Ford Federal Direct Loan DL (formerly known as Stafford Loans), is a federally guaranteed student loan program administered by the U.S. Department of Education. These low interest loans are available for each year of a student’s educational career and are required to be repaid six-months after a student graduates or immediately after a student stops attending school. Direct Loans are repayable over a ten-year period. Direct Loans include extensive Entrance and Exit Counseling Requirements.

Alternative Loans administered through private banks and other lending institutions with basic requirements similar to those of DL - (See Above.) These loans are independently regulated and monitored by the banks and lending institutions with repayments schedules and repayment alternatives all governed by the lenders. All procedures to apply for these loans are in fact similar to that of the Federal Regulated Student loans.

Loans

Academic Excellence: A student must be in good academic standing and should have acquired 12-15 credits per term with a Grade Point Average (G.P.A.) of 2.5 minimum.

Financial Need: This is a Non Need-Based Fund, therefore, its distribution will be determined based on tuition costs after all conventional financial sources have been exhausted.

Procedure: The College will notify the student of the intended award. If student accepts the award, the students account is credited via a financial aid award letter.

Priority: Preference may be given to students:

In Bachelors and Masters Programs.

Who may have exhausted or determined ineligible for conventional Student Financial Aid (SFA) award.

With recommendations from academic administrators and Faculty Facilitators.

Boricua College Scholarship (BCS) Criteria for Eligibility and Selection:

The Federal Work Study Program (FWS) provides eligible students with funds for meeting educational costs. It further provides an opportunity to gain work experience in community and professional settings. Students are paid for approximately 20 hours of work per week at a rate no less than the currently approved minimum wage.

GI Bill for Veterans who served honorably for more than 180 days in the U.S. Armed Services are eligible for education benefits while enrolled in a full-time educational program .

State-Access-VR (VESID) - Adult Career and Continuing Education Services, geared for students with vocational rehabilitation related issues.

Unions and places of employment may also be a resource for educational benefits. One example is the United Federation of Teachers (UFT).

Bursar Short Term Tuition Loans.

Other Financial Resources

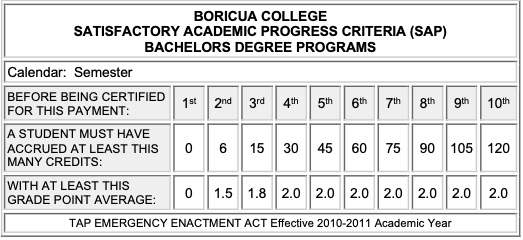

Federal and New York State regulations for financial aid require a student to register for a minimum of 12 credits in order to be on full-time status in the Fall and Spring terms, and minimum of at least six credits in the Summer term. Please note that at Boricua, all curricula leading to degrees require registration in only one course from each of the Five Ways of Learning. Satisfactory Academic Progress (SAP) to receive financial aid requires a student to achieve the grade point average (GPA) according to the tables below:

Satisfactory Academic Progress (SAP) Criteria for Financial Aid:

Program pursuit is defined as receiving a passing or failing grade in a certain percentage of a full-time course load in each term for which an award is received. The percentage increases from 50% of the minimum full-time course load in each term of study in the first year for which an award is received, to 75% of the minimum full-time course load in each term of study in the second year for which an award is received, to 100% of the minimum full-time course load each term thereafter.

Federal and State Program Pursuit (P.P.) Criteria for Financial Aid:

Reinstatement of Financial Aid after Termination: To re-establish Good Academic Standing, a student must make up the deficiency in (SAP) Academic Progress or (P.P.) Program Pursuit requirements: by completing a SAP Appeals package due to personal hardship. If an SAP appeal is approved an “One-time Financial Aid SAP- Appeals Waiver” will be granted based on the appeal in conjunction with the Academic Plan of Action; according to the following procedure:

Attendance Policy for Financial Aid

The federal government will reduce the amount of PELL grant and other federal aid and loans to a student based on their attendance record. Therefore, all institutions participating in the Student Financial Aid programs must determine a policy framework by which to refund the federal government for a student’s lack of attendance. Federal regulations 34 CFR Section 668.22 provides the guidelines for determining the refund policy based on a student’s “Last Date of Attendance.” Boricua College’s policy is presented below:

Upon written appeal by the student and supported in writing by an Academic Administrator, Chairperson of the Department and the student's Faculty Facilitator, the Director of Financial Aid, in consultation with the Vice President of Academic Affairs, will review all data submitted to determine if the student may appeal for waiver” and retain their eligibility for financial aid. The student will be notified of the decision within 30 days of receipt of the appeal. The following types of information or circumstances may be considered in determining whether the student is eligible for a “One-time Financial Aid SAP- Appeal Waiver:” Illness or death in the student's family, illness of the student, academic or economic hardship or other circumstances radically affecting their studies.